The GC Tactical Asset Allocation Program seeks to enhance GC Investment Portfolios

by reducing risk or improving growth potential according to market and economic

conditions. The program utilizes the GC Tactical Fund to make periodic portfolio

adjustments.

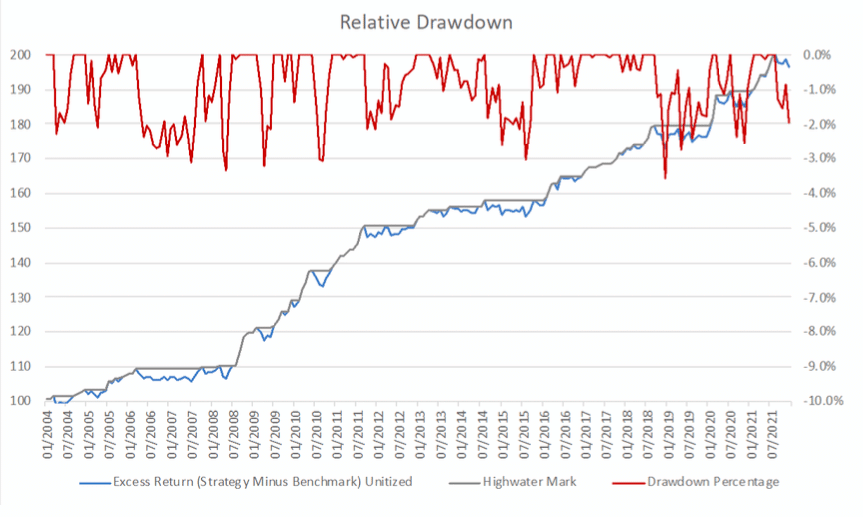

Additionally, the GC Tactical Fund strategy provides consistent excess returns over time as measured by the performance of the fund minus its benchmark of 50% MSCI ACWI and 50% Bloomberg Aggregate Bond indexes. There are three main tactical allocation approaches; neutral, cautious, and aggressive

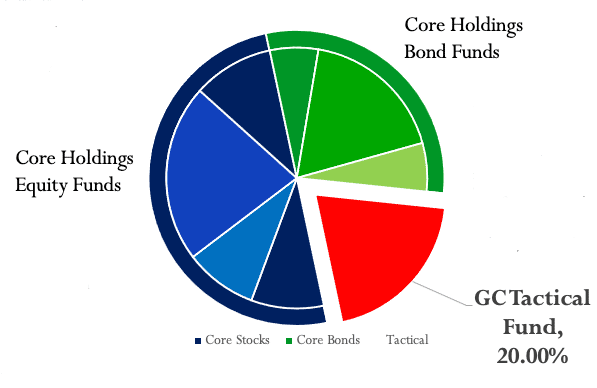

Tactical Asset Allocation with GC Tactical Fund (example)

With other tactical asset allocation programs, investors would need to buy and sell portions of various funds to implement the required changes. This would result in trading activity which the investors must account for monthly in their financial reporting. Frequent trading would also require more stringent oversight of the investment program by treasurers.

The GC Tactical Asset Allocation Program utilizes the GC Tactical Fund within which all trading activities are managed. As all of the trading is conducted inside of the GC Tactical Fund no action is required by the investor to implement the required tactical changes.

The portfolio would have core holdings of equity and bond funds that would not vary over time. Also the GC Tactical Fund would have an allocation that was static. Again all of the trading activities would take place inside the GC Tactical Fund. The performance would be measured at the total portfolio level including all of the core holdings and the GC Tactical Fund.

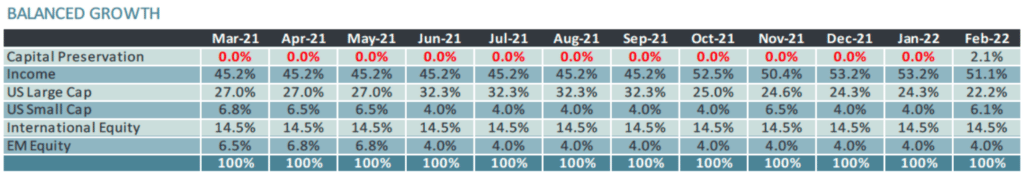

GC Tactical Fund Holdings

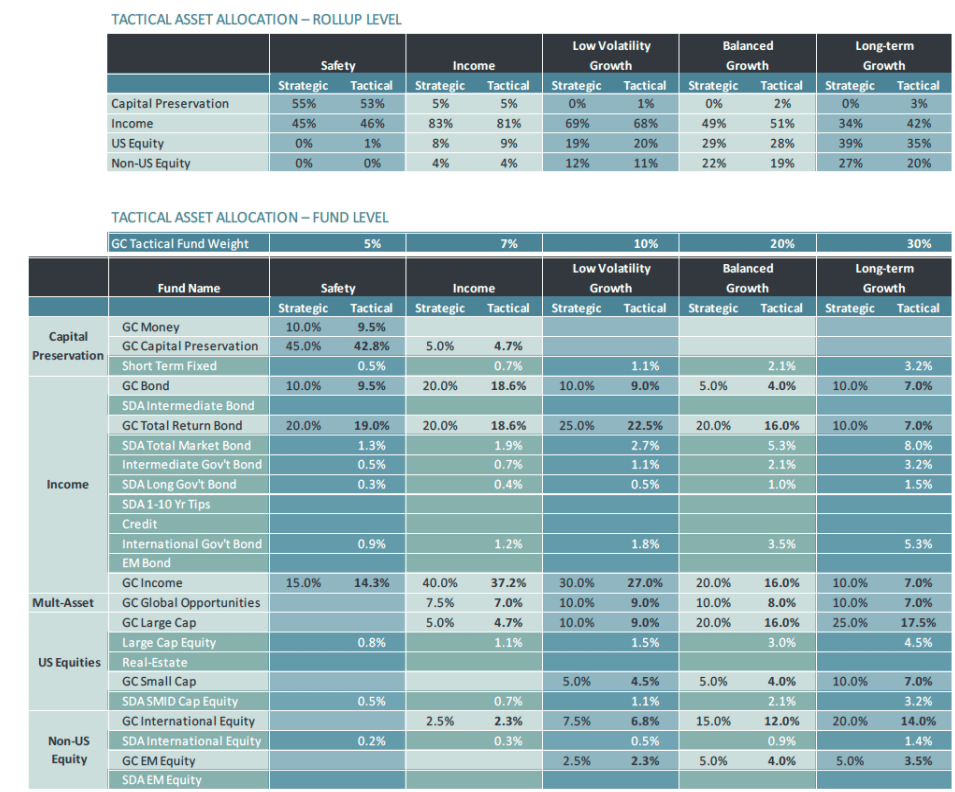

The Tactical Asset Allocation – Rollup Level shows the overall positioning of the model portfolios. The columns marked strategic are the models without the GC Tactical Fund while the column market Tactical have the GC Tactical Fund

Excess Returns and Relative Drawdown